News

Climate Change Levy Increase: How it Will Affect Your Business

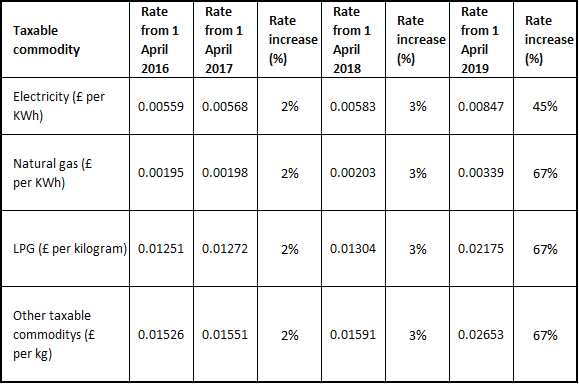

The Climate Change Levy (CCL) is an environmental tax designed to encourage businesses to operate more efficiently an reduce their greenhouse gas emissions. Unless they are exempt, most businesses will pay the main CCL rate on any electricity, gas and solid fuels that they use. After a few years of incremental increases, the main CCL rates for electricity and gas shot up by 45% and 67% respectively from 1 April 2019.  With the latest increase, a small business using 15,000 KWh of electricity and 10,000 KWh of gas per year would see their annual CCL bill increase from £107.75 to £160.95. For a medium-sized business, using 40,000 KWh of electricity and 50,000 KWh of gas each year, the total would increase from £334.70 to £508.30. This shift may have caught some businesses unawares. But for some businesses, it won’t necessarily end up costing them more. In March 2019, the government closed the Carbon Reduction Commitment Energy Efficiency Scheme (CRC). The CRC was a separate efficiency mechanism that made large companies track and buy allowances for carbon emissions. Most CRC businesses will see an overall saving in their environmental taxes because the increase to CCL is less than the CRC charge per KWh. Most small and medium-sized businesses, however, will see their business energy bills increase. Some paint the CCL increase as a way for the chancellor to recoup lost revenue from smaller firms. The CRC scheme will be replaced with a new reporting scheme this year. The new system will be easier to navigate but will cover around three times as many large businesses. The government is also consulting on a new energy efficiency scheme for small and medium-sized businesses. The increase to CCL comes at a time when other green taxes are rising. Since the EU made changes to their Emissions Trading System in 2017, the price of carbon permits has quadrupled. Only certain heavy industrial businesses need to pay this extra carbon tax, but the list of qualifying businesses includes power generators that pass the cost of carbon down the supply chain to individual homes and businesses. Research from Carbon Tracker suggests that EU carbon prices could double by 2021 and quadruple by 2030 if the European Commission legislates to align current emissions targets with the Paris climate agreement.

With the latest increase, a small business using 15,000 KWh of electricity and 10,000 KWh of gas per year would see their annual CCL bill increase from £107.75 to £160.95. For a medium-sized business, using 40,000 KWh of electricity and 50,000 KWh of gas each year, the total would increase from £334.70 to £508.30. This shift may have caught some businesses unawares. But for some businesses, it won’t necessarily end up costing them more. In March 2019, the government closed the Carbon Reduction Commitment Energy Efficiency Scheme (CRC). The CRC was a separate efficiency mechanism that made large companies track and buy allowances for carbon emissions. Most CRC businesses will see an overall saving in their environmental taxes because the increase to CCL is less than the CRC charge per KWh. Most small and medium-sized businesses, however, will see their business energy bills increase. Some paint the CCL increase as a way for the chancellor to recoup lost revenue from smaller firms. The CRC scheme will be replaced with a new reporting scheme this year. The new system will be easier to navigate but will cover around three times as many large businesses. The government is also consulting on a new energy efficiency scheme for small and medium-sized businesses. The increase to CCL comes at a time when other green taxes are rising. Since the EU made changes to their Emissions Trading System in 2017, the price of carbon permits has quadrupled. Only certain heavy industrial businesses need to pay this extra carbon tax, but the list of qualifying businesses includes power generators that pass the cost of carbon down the supply chain to individual homes and businesses. Research from Carbon Tracker suggests that EU carbon prices could double by 2021 and quadruple by 2030 if the European Commission legislates to align current emissions targets with the Paris climate agreement.

CCL Caveats and Exemptions

There are several exemptions and caveats to the CCL that your business may be able to take advantage of. You may be exempt from or get relief from CCL if:

- Your business uses a lot of energy

- You’re a small business that does not use much energy

- You buy energy efficient technology for your business

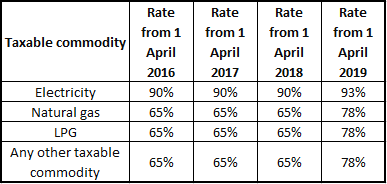

Most businesses in industrial, commercial, agricultural and public services sectors will pay the main CCL rates. Businesses that are exempt from the main CCL rates include charities engaged in non-commercial activities, nursing homes and businesses that consume less than 1,000 KWh per month. Domestic users are also exempt from the CCL. Businesses that operate in energy-intensive industries like steel can pay a reduced rate if they enter into a climate change agreement (CCA) with the Environment Agency. The CCA discount has increased in percentage terms from April, but the increase in CCL rates will mean that CCA businesses will pay more this year unless they use less energy or find another way to reduce the levy burden.

How can companies reduce their CCL burden?

There are three simple ways that businesses can ameliorate the impact of increased CCL. They can generate their own renewable energy, use energy more efficiently or try and procure energy more cheaply.

Investing in on-site renewable generation

The CCL is designed to encourage more businesses to make greener choices. This includes investing in renewable generating technology like solar panels or wind generation. Energy supplied from certain combined heat and power (CHP) schemes registered under the CHP quality assurance (CHPQA) programme is not subject to the levy. Unfortunately, the feed-in-tariff scheme that made renewable energy installations more rewarding was closed to new applicants this year.

Using energy more efficiently

The other main way of reducing your CCL burden is to make sure the business reduces waste and uses energy more efficiently. There are several ways of doing this, including:

- Investing in more efficient machines and technology

- Encouraging staff to save energy

- Installing a smart meter

- Auditing sites and processes to find efficiency savings

Utility Helpline offers a number of energy consultancy services to help your business use energy more efficiently.

Switching to a cheaper deal

Investing in renewable technology and using energy more efficiently can have significant benefits for businesses, but these strategies often involve high up-front costs that many businesses can’t afford. Switching to a cheaper deal won’t reduce the amount of CCL you pay, but it can bring your total energy bill down. The easiest way to switch your energy is by using a specialist business energy broker like Utility Helpline. An energy broker will collect quotes from dozens of suppliers and offer advice on rates and pitfalls with certain companies. Utility Helpline’s energy brokers will also help you choose a fixed-term contract length that suits your business, giving you certainty over your budget and saving money if wholesale prices rise during the contract term.

Want to learn more about Utility Helpline’s range of energy procurement services? Speak to a member of the accounts team today. Call: 0800 043 0423.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money