News

Wholesale Energy Prices Update 27/07/2018

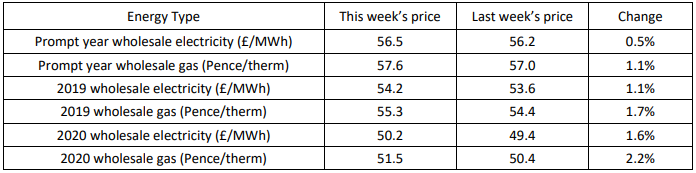

Energy volatility was calmer last week, but many prices still increased. Prices were steady for much of the week, but a flurry of late news saw prices jump around. US storage volumes saw a surprise increase and Saudi Arabia continued to talk about increased production output. But attacks in Saudi Arabia caused a suspension of tanker movements out of some ports and strikes on some North Sea oil fields prompted a price increase. Further price rises were dampened by a small rebound in the value of the pound. Brent oil closed the week up 1.7% at $74.29 per barrel.

Energy volatility was calmer last week, but many prices still increased. Prices were steady for much of the week, but a flurry of late news saw prices jump around. US storage volumes saw a surprise increase and Saudi Arabia continued to talk about increased production output. But attacks in Saudi Arabia caused a suspension of tanker movements out of some ports and strikes on some North Sea oil fields prompted a price increase. Further price rises were dampened by a small rebound in the value of the pound. Brent oil closed the week up 1.7% at $74.29 per barrel.

In the UK, the gas system was relatively balanced throughout much of the week as assets returned from unplanned outages. Gas demand was high as low wind output prompted gas power stations to pick up some of the slack. Upward price pressure came later in the week as annual maintenance on some key North Sea gas assets prepare for planned maintenance. While following gas, electricity also saw price pressure due to the continued low wind output and rising coal prices. All contracts saw slight increases last week with forward prices enduring the largest rises. Short term prices for August rose due to the planned outages at some gas fields, but September and October prices eased again. Winter 2018 saw relatively modest rises, but these prices still hold onto some risk premium. 2019 and 2020 contracts rose slightly higher, but these longer-term contracts are still cheaper than one year deals. With hot weather set to continue, wind output is being kept at a minimum. This reduces the chances of any significant summer dip, but clients who have the time and appetite for risk may still wish to see how the market develops before making a final decision.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money