News

Wholesale energy prices update 25/05/18

The market volatility continued last week in response to ongoing and emerging political issues. Particularly, Trump’s unexpected cancellation of the North Korea summit and the ratcheting worries over Iran further troubled the market and pushed oil up to $80 a barrel, even in spite of an unexpected rise in American storage. Further into the week, Russia and Saudia Arabia announced oil production increases replacing lost output which crashed the market, however this was too late to hit other fuels in the same fashion. Brent finished the week down 4% finishing at $75.30 per barrel.

Back here in the UK, midweek North Sea gas outages pushed up short term prices, compounded by a planned outage at Kolsness which cut flows into the UK right down to zero for a full 24 hours. In response, there was a release from storage and flow reductions to Europe, in order to balance demand. After Kolsness righted itself, the heavily hit oil price also hit gas prices, even though it was late on in the week. Particular impacts were felt on longer-term ones alongside dropping coal prices. Electricity prices fared a lot better, helped by strong solar output throughout the week but, once again, short-term prices moved upwards in response to rising oil and gas.

The market volatility continued last week in response to ongoing and emerging political issues. Particularly, Trump’s unexpected cancellation of the North Korea summit and the ratcheting worries over Iran further troubled the market and pushed oil up to $80 a barrel, even in spite of an unexpected rise in American storage. Further into the week, Russia and Saudia Arabia announced oil production increases replacing lost output which crashed the market, however this was too late to hit other fuels in the same fashion. Brent finished the week down 4% finishing at $75.30 per barrel.

Back here in the UK, midweek North Sea gas outages pushed up short term prices, compounded by a planned outage at Kolsness which cut flows into the UK right down to zero for a full 24 hours. In response, there was a release from storage and flow reductions to Europe, in order to balance demand. After Kolsness righted itself, the heavily hit oil price also hit gas prices, even though it was late on in the week. Particular impacts were felt on longer-term ones alongside dropping coal prices. Electricity prices fared a lot better, helped by strong solar output throughout the week but, once again, short-term prices moved upwards in response to rising oil and gas.

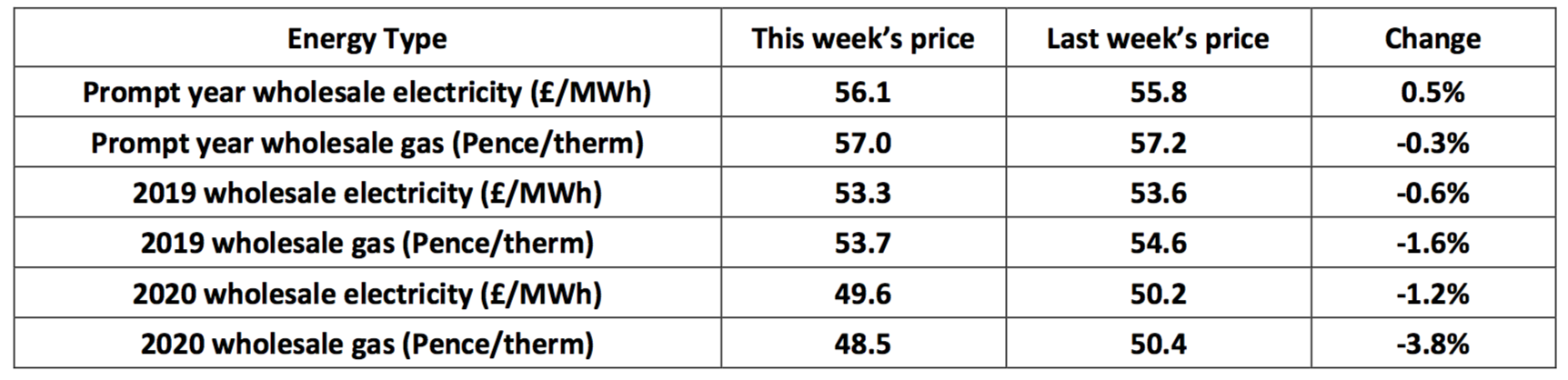

There were minimal changes to short term contracts last week with the aforementioned North Sea and political issues, plus worries over Winter 18 continued to affect prices.

However, those contracts starting prior to this October further increased, affected by ongoing concerns over summer gas demand to replenish Euro supplies. Longer term prices fell, largely because they are more intrinsically linked to oil and impacted by the heavy falls later on in the week. The continuing work being carried out in the North Sea will most probably prolong volatility in short term prices, whilst future year contracts could improve if there are continuing falls in oil prices. The predicted risk on winter 2018 is evident in the fact current two year tariffs are cheaper than one year deals.

There were minimal changes to short term contracts last week with the aforementioned North Sea and political issues, plus worries over Winter 18 continued to affect prices.

However, those contracts starting prior to this October further increased, affected by ongoing concerns over summer gas demand to replenish Euro supplies. Longer term prices fell, largely because they are more intrinsically linked to oil and impacted by the heavy falls later on in the week. The continuing work being carried out in the North Sea will most probably prolong volatility in short term prices, whilst future year contracts could improve if there are continuing falls in oil prices. The predicted risk on winter 2018 is evident in the fact current two year tariffs are cheaper than one year deals.Published by Utility Helpline on (modified )

Talk to us about how we can save you money