News

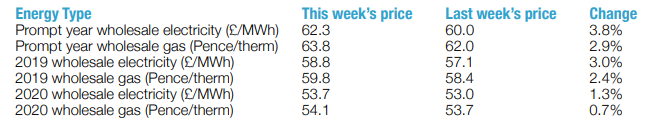

Wholesale Energy Prices Update - 24/08/18

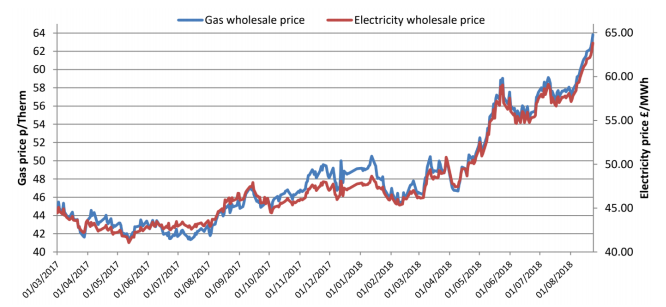

Energy prices continued their unstoppable rise last week, with oil joining in.

Risk in the oil market re-appeared as a large fall in US storage volumes overcame the concerns about the possible US trade war with China. Traders also wait for OPEC’s response to the US sanctions on Iran, which start in November.

Although holding its value against the Dollar, the Pounds continuing decline against the Euro is also pressuring UK prices. Brent closed the week up 5.5% at $75.82 a barrel.

Energy prices continued their unstoppable rise last week, with oil joining in.

Risk in the oil market re-appeared as a large fall in US storage volumes overcame the concerns about the possible US trade war with China. Traders also wait for OPEC’s response to the US sanctions on Iran, which start in November.

Although holding its value against the Dollar, the Pounds continuing decline against the Euro is also pressuring UK prices. Brent closed the week up 5.5% at $75.82 a barrel.

Strikes, maintenance and unexpected outages at North Sea gas plants stoked short-term prices in the UK. While ongoing maintenance at the Troll and Kollsnes fields reduced imported supply to a minimum, leaving the UK undersupplied and pushing prices up further.

Wind generation was low at the start of the week but it did pick up later in the week. Solar levels were also down, so gas generation was required, and electricity saw healthy increases alongside gas.

The weakening Pound against the Euro also kept the pressure on both fuels as they are purchased via European interconnectors.

Contracts saw more large gains last week, especially on the prompt year as concerns continue about supplies for this winter with gas injections into storage suffering due to low volumes being available now.

With oil adding a sudden resurgence and the price of coal and carbon both rising steadily over the week, the entire energy complex is rising, pushing up both gas and electricity costs although less so on longer-term prices.

The October price round is now upon up with suppliers able to pick and choose who they quote for. With the Pound still losing value against the Euro, there are unlikely to be any bargain prices available in the near term

Strikes, maintenance and unexpected outages at North Sea gas plants stoked short-term prices in the UK. While ongoing maintenance at the Troll and Kollsnes fields reduced imported supply to a minimum, leaving the UK undersupplied and pushing prices up further.

Wind generation was low at the start of the week but it did pick up later in the week. Solar levels were also down, so gas generation was required, and electricity saw healthy increases alongside gas.

The weakening Pound against the Euro also kept the pressure on both fuels as they are purchased via European interconnectors.

Contracts saw more large gains last week, especially on the prompt year as concerns continue about supplies for this winter with gas injections into storage suffering due to low volumes being available now.

With oil adding a sudden resurgence and the price of coal and carbon both rising steadily over the week, the entire energy complex is rising, pushing up both gas and electricity costs although less so on longer-term prices.

The October price round is now upon up with suppliers able to pick and choose who they quote for. With the Pound still losing value against the Euro, there are unlikely to be any bargain prices available in the near termPublished by Utility Helpline on (modified )

Talk to us about how we can save you money