News

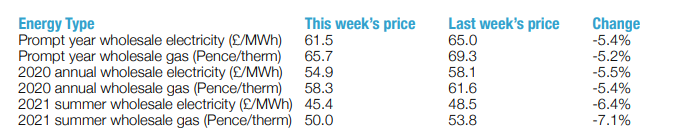

Wholesale Energy Prices Update 12/10/2018

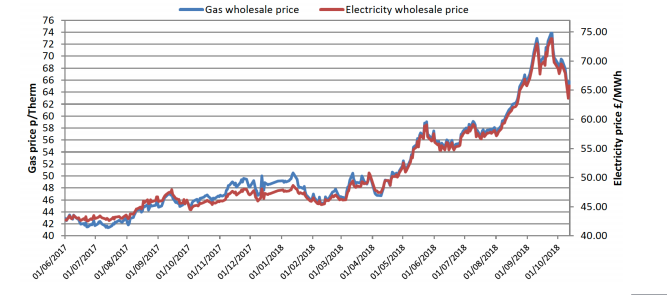

Wholesale energy prices fell sharply last week as markets cooled down. Warm weather across much of Europe, carbon prices retreating from recent highs and a stronger pound all contributed to the downward correction.

European storage levels, which have worried insiders for much of the summer, have reached volumes similar to this point last year. But traders have so far resisted a mass sell-off in the belief that this winter still holds a risk premium.

A recent oil price rally lost some of its steam as hurricane Michael tracked away from the big oil producing areas of the US. An oil demand-reducing trade war is also looking more likely and US storage volumes show a 6-million-barrel jump.

Brent closed the week down 4.4% at $80.43 per barrel.

Wholesale energy prices fell sharply last week as markets cooled down. Warm weather across much of Europe, carbon prices retreating from recent highs and a stronger pound all contributed to the downward correction.

European storage levels, which have worried insiders for much of the summer, have reached volumes similar to this point last year. But traders have so far resisted a mass sell-off in the belief that this winter still holds a risk premium.

A recent oil price rally lost some of its steam as hurricane Michael tracked away from the big oil producing areas of the US. An oil demand-reducing trade war is also looking more likely and US storage volumes show a 6-million-barrel jump.

Brent closed the week down 4.4% at $80.43 per barrel.

In the UK, the gas system was well supplied again. Norwegian flows were healthy and demand for gas is still below seasonal levels because of the mild weather. High wind output has also reduced the demand for power station gas.

With gas, coal and carbon all falling, prices tracked downwards.

All contracts saw sharp falls on the week, but they did rebound on Friday. While some of the risk is being sucked out of prices, they are still holding above levels seen at this time last year.

Shorter-term contracts are holding onto a healthy premium over the following years. Even though European storage volumes are near seasonal norms, several factors could push prices back up.

A messy Brexit still hangs over the value of the pound and exactly what the weather does this Winter will be a mystery as always.

After some recent rises, prices are now similar to their August levels. Many clients may find this an attractive price, but clients that are prepared to wait and take on the extra risk may wish to watch the direction of the market before committing.

In the UK, the gas system was well supplied again. Norwegian flows were healthy and demand for gas is still below seasonal levels because of the mild weather. High wind output has also reduced the demand for power station gas.

With gas, coal and carbon all falling, prices tracked downwards.

All contracts saw sharp falls on the week, but they did rebound on Friday. While some of the risk is being sucked out of prices, they are still holding above levels seen at this time last year.

Shorter-term contracts are holding onto a healthy premium over the following years. Even though European storage volumes are near seasonal norms, several factors could push prices back up.

A messy Brexit still hangs over the value of the pound and exactly what the weather does this Winter will be a mystery as always.

After some recent rises, prices are now similar to their August levels. Many clients may find this an attractive price, but clients that are prepared to wait and take on the extra risk may wish to watch the direction of the market before committing.Published by Utility Helpline on

Talk to us about how we can save you money