News

Wholesale Energy Prices Update 07/09/18

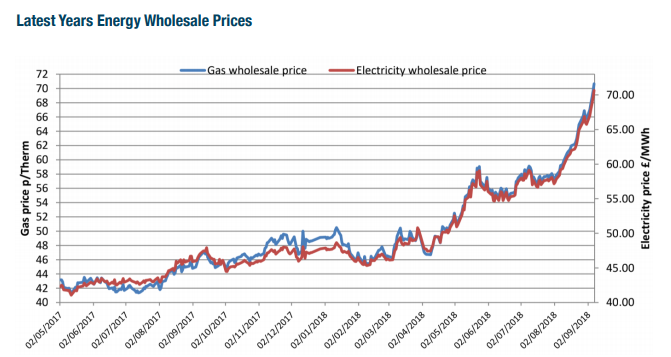

Fresh concerns about the supply of energy this winter lead to more sharp price increases. Oil is still without direction as the supply concerns borne out of the United States sanctions on Iran are balanced against the lower demand for oil due to global trade disputes.

The value of the Pound dropped again last week, pushing the price of oil up further still. European Carbon prices also surged to their highest level in 10 years, making electricity more expensive. Brent closed the week down 1% at $76.83 per barrel.

In the UK, the gas system struggled under the weight of ongoing maintenance and unexpected outages at North Sea gas assets. Pressure in the UK was tempered slightly on Friday when the Belgian interconnector went offline for a short time, preventing exports to the continent.

Ongoing supply problems are dominating the gas market and compounding worries about what volumes will be available for storage this winter. Electricity prices were also hit by rising gas prices and lower wind generation as well as a nuclear power plant going offline in Torness.

Fresh concerns about the supply of energy this winter lead to more sharp price increases. Oil is still without direction as the supply concerns borne out of the United States sanctions on Iran are balanced against the lower demand for oil due to global trade disputes.

The value of the Pound dropped again last week, pushing the price of oil up further still. European Carbon prices also surged to their highest level in 10 years, making electricity more expensive. Brent closed the week down 1% at $76.83 per barrel.

In the UK, the gas system struggled under the weight of ongoing maintenance and unexpected outages at North Sea gas assets. Pressure in the UK was tempered slightly on Friday when the Belgian interconnector went offline for a short time, preventing exports to the continent.

Ongoing supply problems are dominating the gas market and compounding worries about what volumes will be available for storage this winter. Electricity prices were also hit by rising gas prices and lower wind generation as well as a nuclear power plant going offline in Torness.

10-year high carbon prices also drove up electricity prices. This was driven by high European demand throughout the hot August and the withdrawal of carbon certificates by the EU.

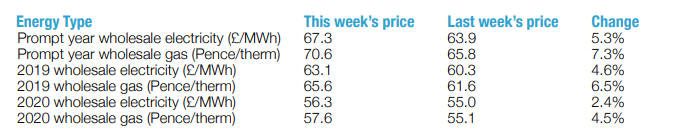

All contracts saw more gains last week as the pressures on the UK systems remain.

With the Pound still weak against the Euro and Dollar, pricing pressures also remain on imported commodities.

As we enter autumn, pricing direction is likely to change according to weather patterns over the next few months. Cold weather, more currency swings and other Brexit factors will be leading the market – so pay attention to the news.

10-year high carbon prices also drove up electricity prices. This was driven by high European demand throughout the hot August and the withdrawal of carbon certificates by the EU.

All contracts saw more gains last week as the pressures on the UK systems remain.

With the Pound still weak against the Euro and Dollar, pricing pressures also remain on imported commodities.

As we enter autumn, pricing direction is likely to change according to weather patterns over the next few months. Cold weather, more currency swings and other Brexit factors will be leading the market – so pay attention to the news.Published by Utility Helpline on

Talk to us about how we can save you money