News

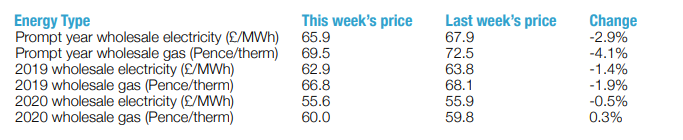

Wholesale Energy Prices Update 28/09/18

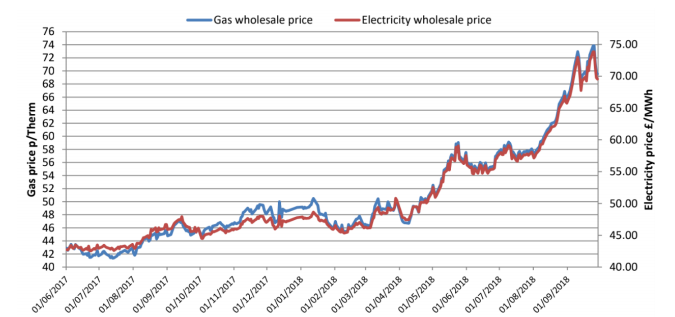

After steep price gains the week before, more volatility last week brought equally about sharp falls.

Global factors continue to play a leading role in the price drama. Oil surged over the week as US sanctions hit Iran’s output harder than expected and no countries made up the shortfall.

But other factors counteracted this upward supply pressure. Falling European carbon and coal prices and slight gains for the Pound saw prices come down. Brent closed the week up 5% at $82.72 a barrel.

After steep price gains the week before, more volatility last week brought equally about sharp falls.

Global factors continue to play a leading role in the price drama. Oil surged over the week as US sanctions hit Iran’s output harder than expected and no countries made up the shortfall.

But other factors counteracted this upward supply pressure. Falling European carbon and coal prices and slight gains for the Pound saw prices come down. Brent closed the week up 5% at $82.72 a barrel.

In the UK, the gas system was oversupplied for most of the week because demand was well below seasonal norms. There was also good supply from Norway, with a recent spate of outages seemingly resolved.

Good wind electricity output over much of the week also saw power station demand for gas reduced, easing short-term prices.

With no other price drivers for longer-term pricing, electricity tracked gas for most of the week, but higher wind output brought larger price falls.

All contracts saw reductions after the previous week’s steep gains, with shorter-term contracts falling the most.

Demand for gas put into storage is still high and some of the risk premium for this winter has disappeared, but prices are still high.

Ongoing mild weather has helped ease demand, but it would take a sustained period of good weather and no bad news or Brexit issues to bring about a prolonged price reduction.

Clients with contract renewals later in the year who are willing to take some risk may wish to see which direction this market takes before committing.

In the UK, the gas system was oversupplied for most of the week because demand was well below seasonal norms. There was also good supply from Norway, with a recent spate of outages seemingly resolved.

Good wind electricity output over much of the week also saw power station demand for gas reduced, easing short-term prices.

With no other price drivers for longer-term pricing, electricity tracked gas for most of the week, but higher wind output brought larger price falls.

All contracts saw reductions after the previous week’s steep gains, with shorter-term contracts falling the most.

Demand for gas put into storage is still high and some of the risk premium for this winter has disappeared, but prices are still high.

Ongoing mild weather has helped ease demand, but it would take a sustained period of good weather and no bad news or Brexit issues to bring about a prolonged price reduction.

Clients with contract renewals later in the year who are willing to take some risk may wish to see which direction this market takes before committing.Published by Utility Helpline on (modified )

Talk to us about how we can save you money