News

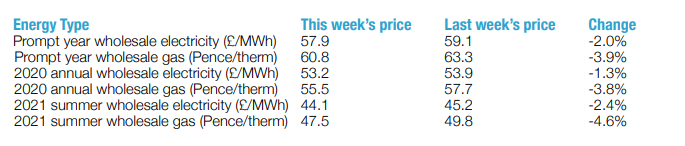

Wholesale Energy Prices Update 02/11/18

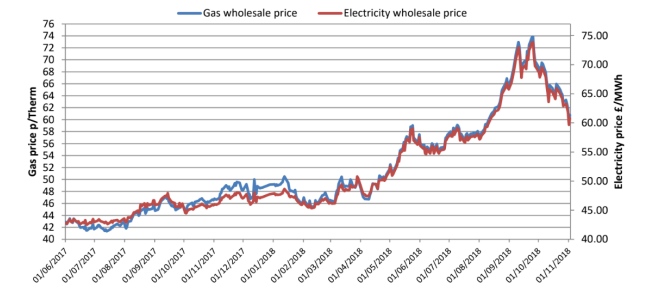

Premium continued to fall out of markets last week as trading fundamentals weakened prices. Oil continued its downward trend as the US signalled that it would permit eight countries to continue buying oil from Iranian oil despite sanctions.

Saudi Arabia also promised to make up any shortfall in supply.

Oil storage volumes in the US climbed for a sixth consecutive week while European carbon and coal prices fell sharply.

Brent oil closed the week down 6.2% at $72.83 per barrel.

Premium continued to fall out of markets last week as trading fundamentals weakened prices. Oil continued its downward trend as the US signalled that it would permit eight countries to continue buying oil from Iranian oil despite sanctions.

Saudi Arabia also promised to make up any shortfall in supply.

Oil storage volumes in the US climbed for a sixth consecutive week while European carbon and coal prices fell sharply.

Brent oil closed the week down 6.2% at $72.83 per barrel.

In the UK, the gas system was well supplied, despite cooler weather flows. Good gas flows from Norway and LNG sources kept the market well balanced.

Cold weather did prompt a small rise on Monday, but prices fell back to an equilibrium in midweek before rising again on Friday.

A nuclear station returned to normal running last week, boosting the supply of electricity and reducing the cost. A low wind forecast pushed the price of electricity up slightly on Friday.

All contracts saw falls last week, with further risk coming out of 2019 prices. The weather has turned colder, but the system continues to cope well.

Prices for the rest of the winter also fell sharply with the first quarter of next year dropping a further 3% over the week.

If there is a mild start to the winter and trading fundamentals continue to soften, then prices may drop further in the next few weeks. But risk-averse contracts may not want to wait until 2019 to make up their mind – especially with Brexit risks yet to play out.

In the UK, the gas system was well supplied, despite cooler weather flows. Good gas flows from Norway and LNG sources kept the market well balanced.

Cold weather did prompt a small rise on Monday, but prices fell back to an equilibrium in midweek before rising again on Friday.

A nuclear station returned to normal running last week, boosting the supply of electricity and reducing the cost. A low wind forecast pushed the price of electricity up slightly on Friday.

All contracts saw falls last week, with further risk coming out of 2019 prices. The weather has turned colder, but the system continues to cope well.

Prices for the rest of the winter also fell sharply with the first quarter of next year dropping a further 3% over the week.

If there is a mild start to the winter and trading fundamentals continue to soften, then prices may drop further in the next few weeks. But risk-averse contracts may not want to wait until 2019 to make up their mind – especially with Brexit risks yet to play out.Published by Utility Helpline on

Talk to us about how we can save you money