News

Wholesale energy prices update 25/8/17

After lots of price rises, last week brought something of a breather to global markets. They continued to look for direction with oil trading in a tight band – Hurricane Harvey, however, could see prices rise once the full impact of the devastation is seen. Oil stayed within a limited price range with another drop in US storage levels being offset by continued supply growth. Traders are still waiting to see if the falls are just seasonal trends at a time of peak petrol demand or if other factors are at play. Brent closed the week down 1.5% at $51.89 a barrel.

After lots of price rises, last week brought something of a breather to global markets. They continued to look for direction with oil trading in a tight band – Hurricane Harvey, however, could see prices rise once the full impact of the devastation is seen. Oil stayed within a limited price range with another drop in US storage levels being offset by continued supply growth. Traders are still waiting to see if the falls are just seasonal trends at a time of peak petrol demand or if other factors are at play. Brent closed the week down 1.5% at $51.89 a barrel.

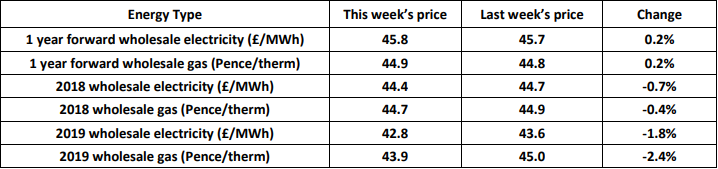

In the UK, prices stalled as the Norwegian Kollsnes gas plant went back on line earlier than expected. Warmer temperatures also eased some of the price risk. With a relatively balanced gas system, demand from power stations eased up and a drop in oil prices early in the week eased prices. They did recover later in the week as Hurricane Harvey was upgraded from a Tropical Wave to a Tropical Storm and finally to a Hurricane. Electricity prices followed suit with power stations returning to service and renewables holding up, removing some risk. Short term contracts saw little change last week but medium and longer term saw falls, especially for 2019. The risk is still seen on this winter due to the unknown effect of the Rough storage closure on both gas and electricity pricing. It still seems unlikely that sustained lower prices will be seen going into the autumn and, depending on the impacts of hurricane Harvey, we could see further upward pressure. Given this uncertainty over winter supply margins, while short term opportunities may still present themselves through the remainder of the summer and early autumn, prices may rise so clients should monitor markets closely.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money