News

Wholesale energy prices update 17/11/17

OPEC maintained their ongoing discussion of extending production cuts, although Russia appeared a little cooler on this. The IEA predicted a reduction in demand for oil in 2018, the warmer weather forcing them to revise their expectations down. On top of this there was an unexpected rise in US storage inventories and production reached a new record high. Despite continuing political uncertainty in the Middle East, there was reticence throughout the week from traders who had until recently put their support behind oil. Steep falls in coal prices further contributed, although there were late gains seen on Friday. Brent finished the week 1.3% lower at $62.72 a barrel.

The UK saw the gas system holding up well again, in spite of the continued colder weather. Demand remains lower than the seasonal averages and, for most of the week, the system was long. Increased gas station demand with low renewable output early on in the week, unusually, did nothing to temper this. Drops in oil, coal and gas conspired to pull down electricity prices, even with the low renewables output. However, this had recovered by the end of the week.

OPEC maintained their ongoing discussion of extending production cuts, although Russia appeared a little cooler on this. The IEA predicted a reduction in demand for oil in 2018, the warmer weather forcing them to revise their expectations down. On top of this there was an unexpected rise in US storage inventories and production reached a new record high. Despite continuing political uncertainty in the Middle East, there was reticence throughout the week from traders who had until recently put their support behind oil. Steep falls in coal prices further contributed, although there were late gains seen on Friday. Brent finished the week 1.3% lower at $62.72 a barrel.

The UK saw the gas system holding up well again, in spite of the continued colder weather. Demand remains lower than the seasonal averages and, for most of the week, the system was long. Increased gas station demand with low renewable output early on in the week, unusually, did nothing to temper this. Drops in oil, coal and gas conspired to pull down electricity prices, even with the low renewables output. However, this had recovered by the end of the week.

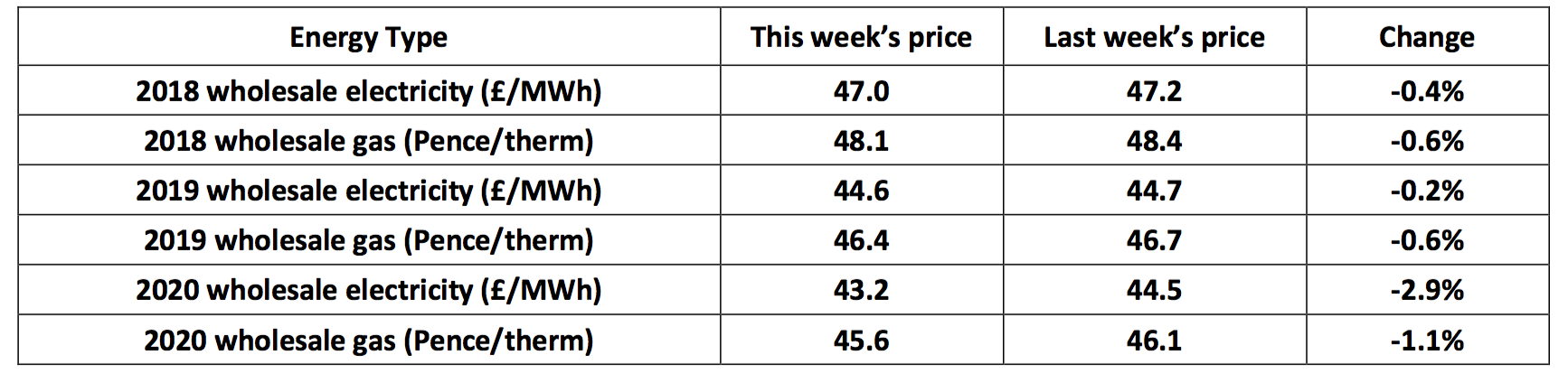

There were falls seen across all contracts last week, however 2018 and 2019 contracts only fell slightly in comparison. There were bigger falls seen on contracts with longer dates, influenced by the falls in coal and oil. Q1 2018 (Jan to Mar) gas and electricity prices for saw the biggest falls - longer term forecasts predicting a warm winter, at least so far. Additionally, the ongoing events in the Middle East are still contributing to the continued market volatility.

If you throw in the ongoing nuclear inspections in France, there is much uncertainty this winter still, so our advice is for clients to carry on monitoring markets closely. Keep an eye out for any developing price patterns as we learn more about the weather outlook for winter and be ready to contract in the event of any market dips.

There were falls seen across all contracts last week, however 2018 and 2019 contracts only fell slightly in comparison. There were bigger falls seen on contracts with longer dates, influenced by the falls in coal and oil. Q1 2018 (Jan to Mar) gas and electricity prices for saw the biggest falls - longer term forecasts predicting a warm winter, at least so far. Additionally, the ongoing events in the Middle East are still contributing to the continued market volatility.

If you throw in the ongoing nuclear inspections in France, there is much uncertainty this winter still, so our advice is for clients to carry on monitoring markets closely. Keep an eye out for any developing price patterns as we learn more about the weather outlook for winter and be ready to contract in the event of any market dips.Published by Utility Helpline on (modified )

Talk to us about how we can save you money