News

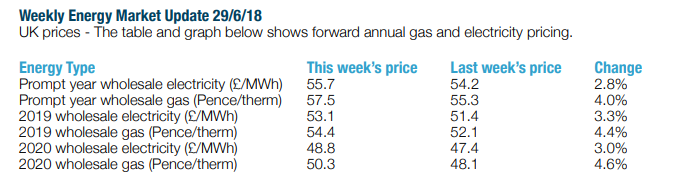

Wholesale Energy Prices Update 29/06/2018

Energy commodity prices increased sharply last week following an OPEC summit. Although OPEC member countries and Russia agreed to increase production, prises rose on news of potential supply disruptions elsewhere. An incident at a Canadian facility has threated a temporary shortage in North America and President Trump’s isolationist Iran agenda seems likely to remove large volume from the market. Renewed political strife in Libya and a large fall in US storage levels also contributed to a dip in output. Brent closed the week up 5.1% at $79.44.  In the UK, annual maintenance carried out on the UK-Belgium interconnector finished, but prices did not fall as expected during the service. Despite not being able to export gas to Europe, continued North Sea outages kept the system balanced. Prices held their premiums even though the critical Troll/Kollsnes field is due to return over the weekend. Low wind output for much of the week also saw electricity under pressure as well as increasing gas demand from power stations. All contracts saw significant increases last week, with longer term contracts showing the highest gains from rising oil prices. Shorter term contracts remain under pressure as Winter 2018 holds onto a high-risk premium in Europe. Longer term contracts are still being priced cheaper than one-year deals. Given the ongoing oil price rises and political developments threatening, clients that have time may wish to wait and see how this market develops before making longer-term decisions.

In the UK, annual maintenance carried out on the UK-Belgium interconnector finished, but prices did not fall as expected during the service. Despite not being able to export gas to Europe, continued North Sea outages kept the system balanced. Prices held their premiums even though the critical Troll/Kollsnes field is due to return over the weekend. Low wind output for much of the week also saw electricity under pressure as well as increasing gas demand from power stations. All contracts saw significant increases last week, with longer term contracts showing the highest gains from rising oil prices. Shorter term contracts remain under pressure as Winter 2018 holds onto a high-risk premium in Europe. Longer term contracts are still being priced cheaper than one-year deals. Given the ongoing oil price rises and political developments threatening, clients that have time may wish to wait and see how this market develops before making longer-term decisions.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money