News

Weekly Energy Market Update 10/2/17

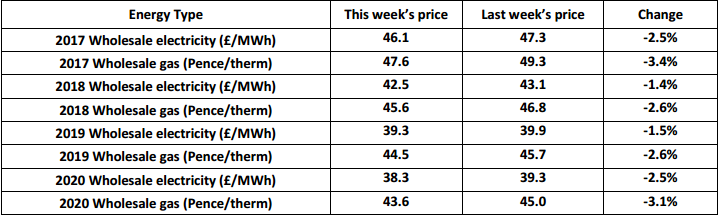

UK prices - The table and graph below shows the forward annual gas and electricity pricing  Last week brought another week of stagnation, with markets losing much of last week's gains. Oil prices fell early on in the week after doubts continued to emerge about the sanctity of OPEC's proposed production cut. US production continued on its upward production trajectory and pound sterling has another good week. Later in the week, a large part of these losses were reversed when US oil storage levels fell unexpectedly on Friday and OPEC announced that it was on course with 90% compliance to their production targets. But any gains were dampened by the three OPEC nations without target ramping up production - offsetting production cuts elsewhere. And because Saudi Arabia cut more than they needed to, traders yet to be convinced that all OPEC members will stick to their targets. Brent closed the week almost unchanged at $56.70 a barrel.

Last week brought another week of stagnation, with markets losing much of last week's gains. Oil prices fell early on in the week after doubts continued to emerge about the sanctity of OPEC's proposed production cut. US production continued on its upward production trajectory and pound sterling has another good week. Later in the week, a large part of these losses were reversed when US oil storage levels fell unexpectedly on Friday and OPEC announced that it was on course with 90% compliance to their production targets. But any gains were dampened by the three OPEC nations without target ramping up production - offsetting production cuts elsewhere. And because Saudi Arabia cut more than they needed to, traders yet to be convinced that all OPEC members will stick to their targets. Brent closed the week almost unchanged at $56.70 a barrel.

In the UK, falling oil prices put downward price pressure on gas and electricity. A long gas system and warmer weather forecasts also pushed gas prices down. The markets seemed to ignore oil's rally call on Friday to continue downwards. Electricity was helped by lower coal prices and increased renewables towards the week's end. Gains prompted by the Iran missile test last week were lost this week. With warmer forecasts being made for the end of February, the potential for winter weather to push up prices is evaporating, but a cold snap could quickly change that. Many energy buyers may wait to see a more clear market direction, but risk averse buyers may consider buying now to avoid volatility in the future.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money