News

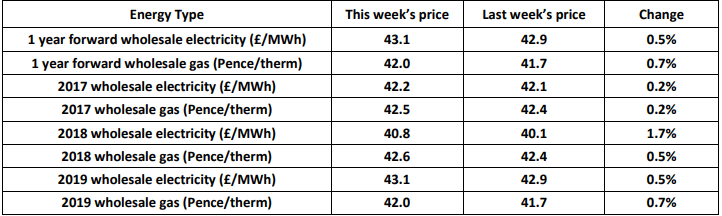

Wholesale energy prices update 07/07/17

The first full week of July trading brought more slight price movements upwards. Rollercoaster oil prices surged initially before Russia announced that they would not consider additional production falls. Drops in US oil storage levels were largely ignored because production from drilling rigs increased after storm Cindy passed through the Gulf of Mexico. Supply from North African countries Nigeria and Libya also increased and Brent closed the week down 4.5% at $46.71 per barrel.

The first full week of July trading brought more slight price movements upwards. Rollercoaster oil prices surged initially before Russia announced that they would not consider additional production falls. Drops in US oil storage levels were largely ignored because production from drilling rigs increased after storm Cindy passed through the Gulf of Mexico. Supply from North African countries Nigeria and Libya also increased and Brent closed the week down 4.5% at $46.71 per barrel.

In the UK, gas prices rose initially on a short system after the Belgian interconnector resumed operation in export mode. Further issues at Norwegian gas plants lead to lower imports and lower renewables generation exacerbated the supply problems. The system eased up later in the week and prices started to come down. With 2 LNG cargoes expected within 10 days, price risks began to be removed. Continued electricity generating station unavailability and low renewable output left tight margins which added a premium to electricity. Rising coal also helped lift both fuels. All contracts rose slightly last week. As gas and electricity systems teetered on a knife edge, risk is playing a leading role in determining prices. With Rough Storage Facility still not available, a lack of LNG deliveries and struggling Norwegian assets, uncertainty in prices could cause chaos during the winter months. Clients with renewal dates in mid or late winter still may want to consider contracting earlier and avoiding this volatility.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money