News

Wholesale energy prices update 15/11/17

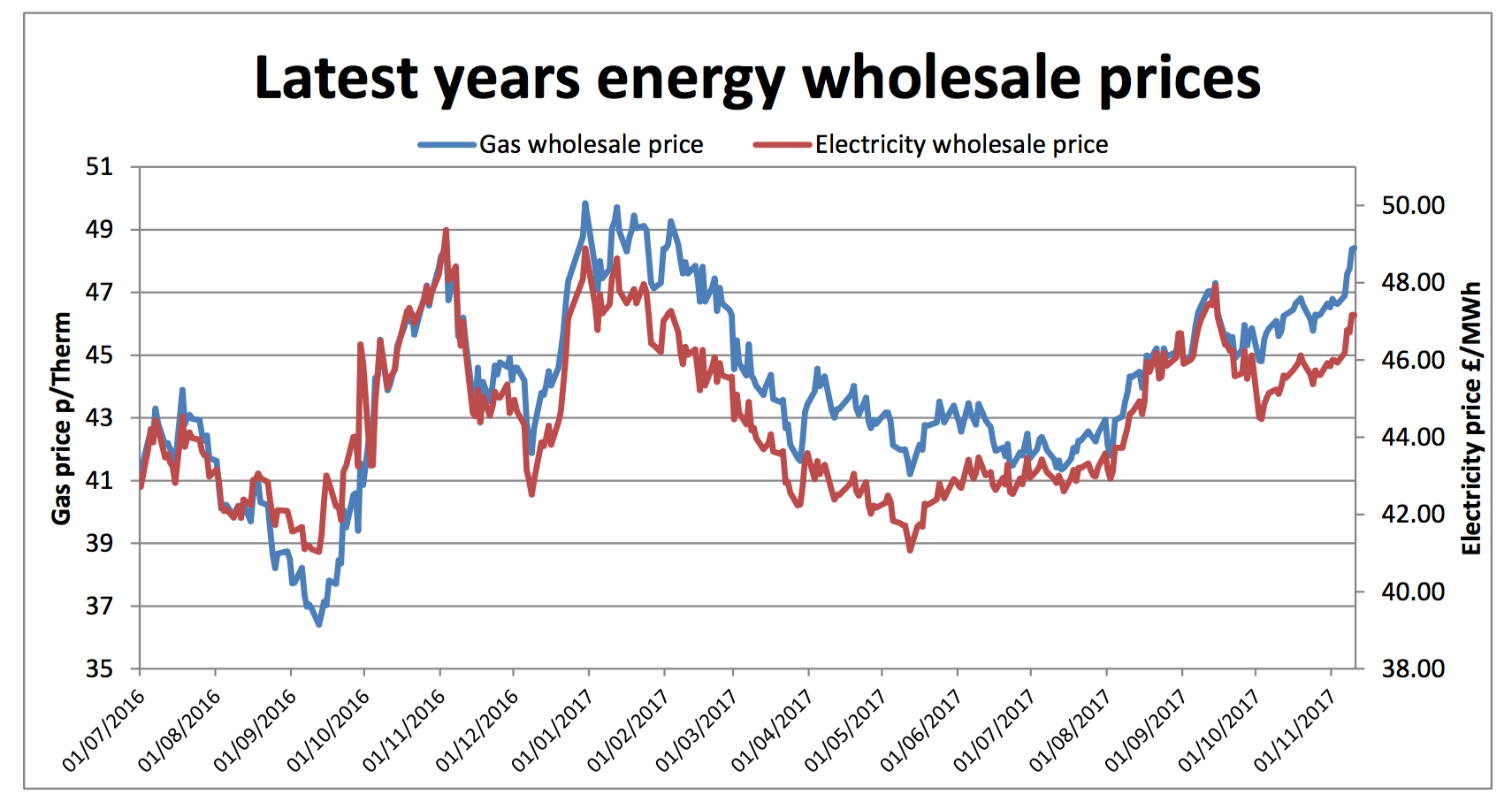

The recent market stability turned out to be the calm before the storm as there was a return to volatility last week. Markets climbed again with the news that OPEC and Russia were still planning reductions in supply and possible increases in next year’s oil demand. Meanwhile, Saudi Arabia carried out a large anti-corruption purge resulting in the arrests of a great number of senior people. This coupled with the situation in Yemen (a fired missile which was destroyed) unsettled the market considerably. These inevitable volatility pressures, the rising price of coal, the arrival of cold weather in Europe and low European renewables output pushed gas and power prices upwards. The week ended with Brent closing 2.3% higher at $63.52 a barrel.

Here in the UK, the weather continued to get colder, pushing gas demand up and prompting frequent withdrawals of gas from the short term storage; for this to be happening so soon into winter is a concern, as it may be difficult to replenish the supplies. Lower renewables output also pushed up demand for power station energy. Gas exports from storage to Europe put pressure on prices with them climbing in spite of how well the gas system has been coping. The rises in gas, oil and coal pushed electricity prices up, with additional pressure from the lower renewables output and continued French nuclear outages.

The recent market stability turned out to be the calm before the storm as there was a return to volatility last week. Markets climbed again with the news that OPEC and Russia were still planning reductions in supply and possible increases in next year’s oil demand. Meanwhile, Saudi Arabia carried out a large anti-corruption purge resulting in the arrests of a great number of senior people. This coupled with the situation in Yemen (a fired missile which was destroyed) unsettled the market considerably. These inevitable volatility pressures, the rising price of coal, the arrival of cold weather in Europe and low European renewables output pushed gas and power prices upwards. The week ended with Brent closing 2.3% higher at $63.52 a barrel.

Here in the UK, the weather continued to get colder, pushing gas demand up and prompting frequent withdrawals of gas from the short term storage; for this to be happening so soon into winter is a concern, as it may be difficult to replenish the supplies. Lower renewables output also pushed up demand for power station energy. Gas exports from storage to Europe put pressure on prices with them climbing in spite of how well the gas system has been coping. The rises in gas, oil and coal pushed electricity prices up, with additional pressure from the lower renewables output and continued French nuclear outages.

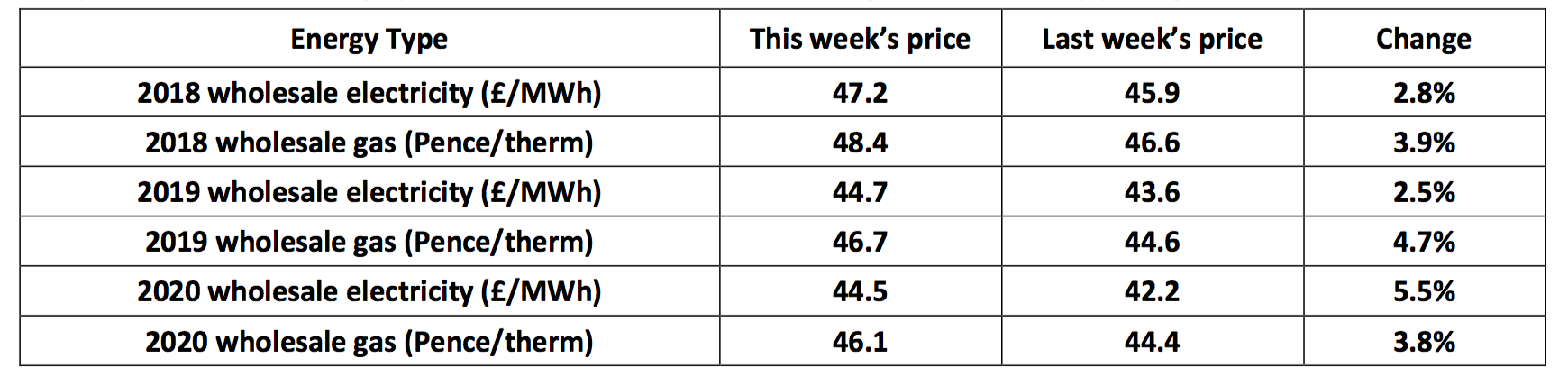

There were big price jumps across all contracts as the winter weather deepened and in response to pressure from oil price rises. There were sharp climbs in 2018 Q1 gas and electricity prices (January to March) in response to the chilly weather and lack of immediate LNG cargos in sight. The tumultuous markets were rocked further last week, pressurised by concerns over the worrying political landscape in the Middle East. The continuing nuclear inspections in France spread the uncertainty across to the electricity market.

Utility Helpline recommend that clients pay close attention to market variations, watching closely for price patterns as winter deepens and being prepared to contract in event of a dip.

There were big price jumps across all contracts as the winter weather deepened and in response to pressure from oil price rises. There were sharp climbs in 2018 Q1 gas and electricity prices (January to March) in response to the chilly weather and lack of immediate LNG cargos in sight. The tumultuous markets were rocked further last week, pressurised by concerns over the worrying political landscape in the Middle East. The continuing nuclear inspections in France spread the uncertainty across to the electricity market.

Utility Helpline recommend that clients pay close attention to market variations, watching closely for price patterns as winter deepens and being prepared to contract in event of a dip.Published by Utility Helpline on (modified )

Talk to us about how we can save you money