News

Wholesale energy prices update 29/9/17

Last week brought more volatility to the energy markets, but with little overall change. Markets rested as world events took their course. With the US still recovering from recent hurricanes, the independence referendum in Iraqi Kurdistan, continued currency fluctuations and no concrete news from the latest OPEC meeting - markets continued to trade on sentiment. Oil gained earlier in the week, on the expectation that supply might be restricted (primarily due to the political situation in Kurdistan), but by the weeks-end, any growth had been cancelled out by changes in the Pound. Brent closed the week unchanged at $56.79 a barrel.

Last week brought more volatility to the energy markets, but with little overall change. Markets rested as world events took their course. With the US still recovering from recent hurricanes, the independence referendum in Iraqi Kurdistan, continued currency fluctuations and no concrete news from the latest OPEC meeting - markets continued to trade on sentiment. Oil gained earlier in the week, on the expectation that supply might be restricted (primarily due to the political situation in Kurdistan), but by the weeks-end, any growth had been cancelled out by changes in the Pound. Brent closed the week unchanged at $56.79 a barrel.

UK Prices

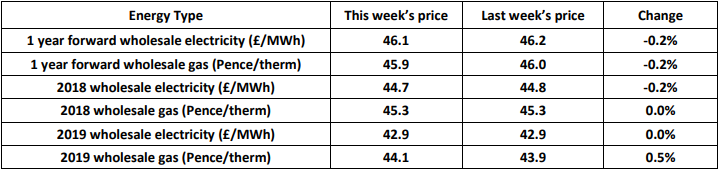

In the UK, both gas and electricity were relatively well balanced across the week. Some pressure was introduced as a number of French nuclear sites were taken offline, increasing gas consumption. Colder weather forecasts also increased demand for gas. But good renewable output mitigated a good portion of this increase, reducing power demand. Relatively static oil and coal prices allowed gas and electricity to change little. All contracts saw virtually no change on the week as markets cooled following the run of increases throughout the summer. The price gap between the coming year and future years remains still making 2 and 3-year prices quite attractive, at least until the full impact of a winter without the Rough gas storage facility is fully understood. Markets are tetchy about the possibility of a volatile winter, with a high degree uncertainty over gas supplies and the corresponding effect on electricity. If the winter turns out to be mild, then lower price windows may be seen, but given current market conditions, clients should monitor markets closely and consider contracting in any price dip.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money