News

Wholesale Energy Prices Update 29/03/18

Before the long Easter weekend, the short week brought further increases in energy markets after initial falls. Despite falling early in the week, energy markets rose on the prospect of poor European weather forecasts. A bleak Easter weekend combined with forecasts for a colder-than-average April, pushed prices upwards as markets continued to fret about low storage levels across Europe. Oil prices stagnated this week as US storage levels continued to rise. This was in spite of some of the political tension caused by Donald Trump’s latest White House appointments. Brent closed the week down 1.7% at $69.34 a barrel.

Before the long Easter weekend, the short week brought further increases in energy markets after initial falls. Despite falling early in the week, energy markets rose on the prospect of poor European weather forecasts. A bleak Easter weekend combined with forecasts for a colder-than-average April, pushed prices upwards as markets continued to fret about low storage levels across Europe. Oil prices stagnated this week as US storage levels continued to rise. This was in spite of some of the political tension caused by Donald Trump’s latest White House appointments. Brent closed the week down 1.7% at $69.34 a barrel.

UK business energy prices

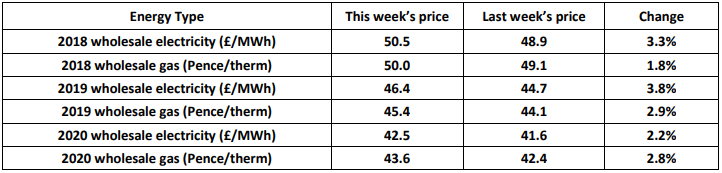

In the UK, colder weather forecasts for Easter and April kept gas supply fears at the forefront of trader minds as the system continues to struggle with Rough unavailable. Three LNG deliveries helped ease some of the upward pressure but prices still rose throughout the week. The outage of the Vesterled pipeline may reduce supplies for longer than expected but flows from Europe remain healthy and good renewable generation helped ease power station gas demand. Electricity prices were also put under pressure as nuclear plant outages made electricity costs increase more than gas. Coal continued to run, even with the high renewables output. All contracts increased in price last week with year ahead prices for electricity increasing by more than 3% and gas contracts gaining 1.8%. Weather patterns are still a big risk for UK businesses. So far, forecasts for April vary but these will become clearer over the next week or so.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money