News

Wholesale energy prices update 13/10/17

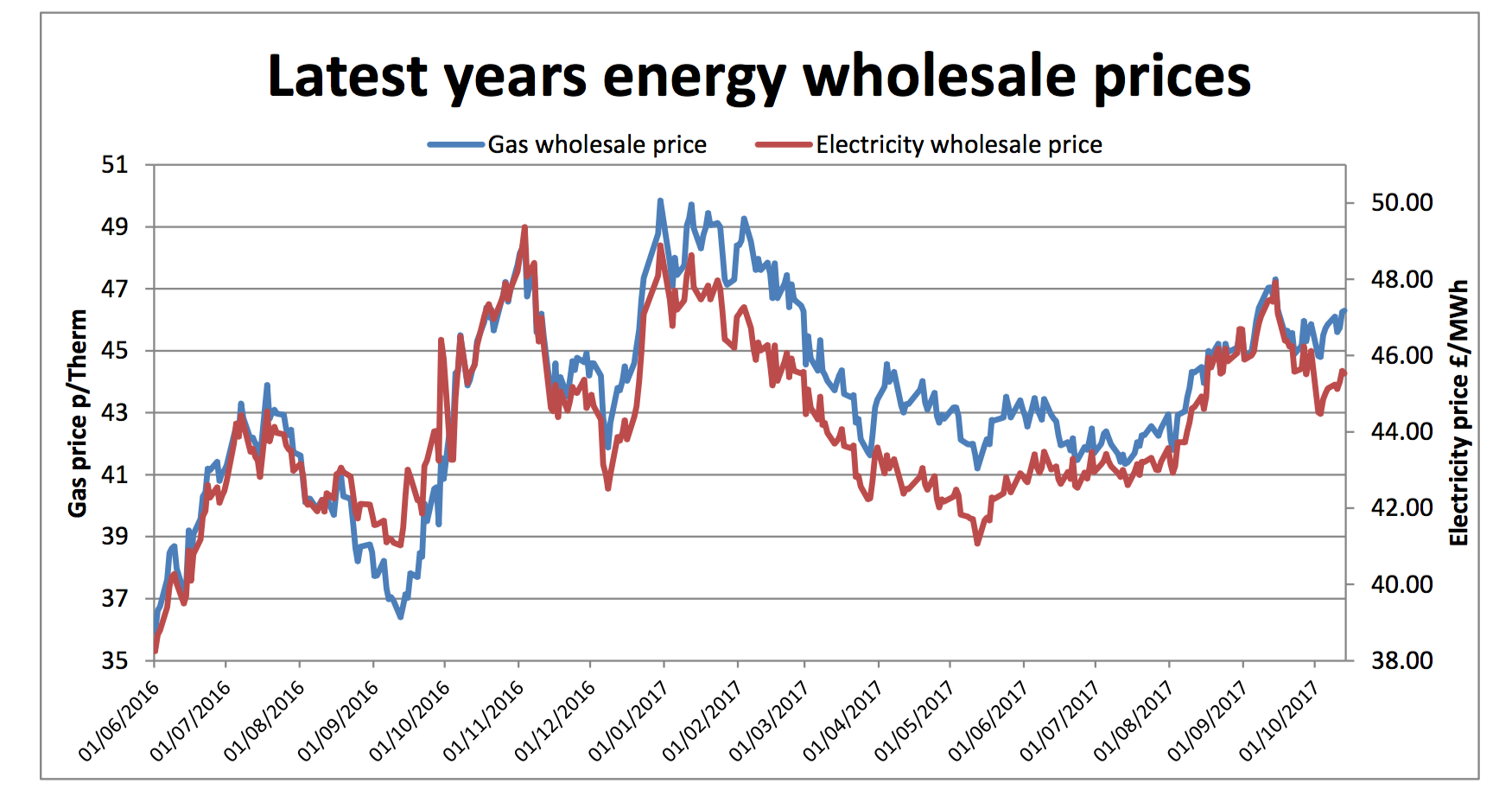

There was a return to upward price pressure last week. Political events allied with continuing issues with the French nuclear fleet forced a rise in global energy prices again. The ongoing Iraqi / Kurdish conflict around the Kirkuk oil assets in inevitably unsettled the market as threats arose that 600,000 barrels of oil could be locked in should Turkey decide to shut off a key pipeline. There was further upward pressure on oil markets in response to statements coming from OPEC warning of increasing demand and falling supply. However, figures only showed a slight re-balancing of the markets. Brent ended the week up 2.8% at $57.17 a barrel.

In the UK, continuing maintenance at the Norwegian gas fields, and the ensuing pressure on the system, forced short term prices up. However, these price rises were mitigated by good wind output, reduced British demand and withdrawals from gas storage. Coal prices climbed too, putting further pressure on European and UK prices. As mentioned above, ongoing problems with the French nuclear fleet caused by inspections notifying of significant safety events forced electricity prices upwards, however these prices fell back again on Friday.

There was a return to upward price pressure last week. Political events allied with continuing issues with the French nuclear fleet forced a rise in global energy prices again. The ongoing Iraqi / Kurdish conflict around the Kirkuk oil assets in inevitably unsettled the market as threats arose that 600,000 barrels of oil could be locked in should Turkey decide to shut off a key pipeline. There was further upward pressure on oil markets in response to statements coming from OPEC warning of increasing demand and falling supply. However, figures only showed a slight re-balancing of the markets. Brent ended the week up 2.8% at $57.17 a barrel.

In the UK, continuing maintenance at the Norwegian gas fields, and the ensuing pressure on the system, forced short term prices up. However, these price rises were mitigated by good wind output, reduced British demand and withdrawals from gas storage. Coal prices climbed too, putting further pressure on European and UK prices. As mentioned above, ongoing problems with the French nuclear fleet caused by inspections notifying of significant safety events forced electricity prices upwards, however these prices fell back again on Friday.

There were small rises across all contracts last week, however those with the shorter dates gained the most. Also rising were prompt prices for the remaining winter months, particularly quarter one of 2018. This price pressure arose from continuing concerns about winter gas. Further ahead prices saw more pressure from fluctuations in coal, oil and the currency markets.

This winter, we expect to see markets continuing to be exposed to the risk of volatile prices, largely affected by the uncertainty over gas supplies and the inevitable knock on effect to electricity markets. There is a chance we may see lower price windows should the winter transpire to be a mild one but our advice, based on existing market conditions, is to monitor markets closely and consider contracting in the event of any price dip.

There were small rises across all contracts last week, however those with the shorter dates gained the most. Also rising were prompt prices for the remaining winter months, particularly quarter one of 2018. This price pressure arose from continuing concerns about winter gas. Further ahead prices saw more pressure from fluctuations in coal, oil and the currency markets.

This winter, we expect to see markets continuing to be exposed to the risk of volatile prices, largely affected by the uncertainty over gas supplies and the inevitable knock on effect to electricity markets. There is a chance we may see lower price windows should the winter transpire to be a mild one but our advice, based on existing market conditions, is to monitor markets closely and consider contracting in the event of any price dip.Published by Utility Helpline on (modified )

Talk to us about how we can save you money