News

Weekly Energy Market Update 30/12/16

The week to Friday the 30th of December saw a short trading week, but significant price increases. Oil prices continued to rise as promised Opec production cuts would limit the supply of oil from January 1st. GBP lost value against EUR and USD, creating upward price pressure and forecasts for colder temperatures across much of Europe in January pushed future prices up further still. Brent closed the week up 3.6% at $56.82 a barrel.

The week to Friday the 30th of December saw a short trading week, but significant price increases. Oil prices continued to rise as promised Opec production cuts would limit the supply of oil from January 1st. GBP lost value against EUR and USD, creating upward price pressure and forecasts for colder temperatures across much of Europe in January pushed future prices up further still. Brent closed the week up 3.6% at $56.82 a barrel.

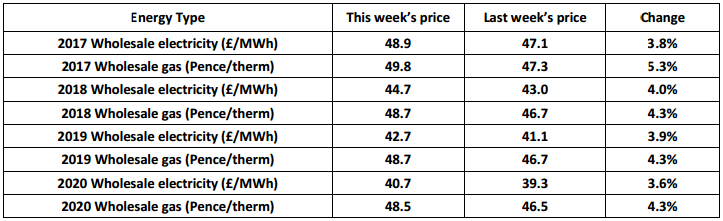

In the UK, the gas system was short or balanced because limited withdrawals were allowed from Rough storage. Even on a lower demand, this prompted sharp price rises. The cold forecast for much of January also pushed prices up sharply for quarter 1 contracts, with oil also adding pressure. Electricity prices followed gas with planned outages affecting supply, despite healthy wind generation output. Low French temperatures forecast for January also put upward pressure on prices as this will mean less import capacity for the UK. All contracts increased sharply over the week by between 3 and 5 per cent. Prices continued their rise from before Christmas with oil continuing to provide upward pressure as the Opec cuts are about to land. Although implementation could still be patchy, traders are betting on production cuts which are pushing market prices up. With the first frosts starting to bite, the cold weather is also putting pressure on prices.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money