News

Wholesale energy prices update 23/6/17

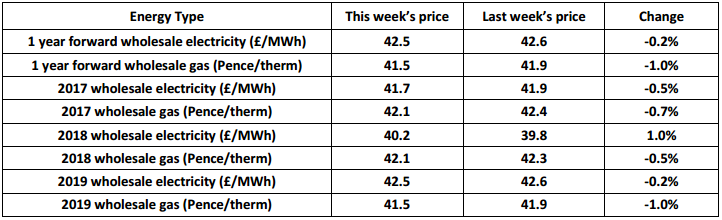

Last week saw a continuation of the volatility on the energy market, but with little change overall. Tensions continue to simmer around Qatar although, but nervousness about the diplomatic situation does not appear to be driving markets. Oil price continued to fall with rising supplies from the US, Libya and Nigeria. The falling oil price adds to the view that OPEC's production cuts aren't working out as the member countries had hoped. Brent closed the week down 2.9% at $45.54 a barrel.

Last week saw a continuation of the volatility on the energy market, but with little change overall. Tensions continue to simmer around Qatar although, but nervousness about the diplomatic situation does not appear to be driving markets. Oil price continued to fall with rising supplies from the US, Libya and Nigeria. The falling oil price adds to the view that OPEC's production cuts aren't working out as the member countries had hoped. Brent closed the week down 2.9% at $45.54 a barrel.

In the UK, gas prices were also volatile. Ongoing problems at two Norwegian gas plants meant that UK flows dropped markedly and caused a short gas system for much of the week. The announcement that the Rough storage facility, the largest gas storage facility in the UK, was unlikely to ever return full working service saw injections rising at other facilities, adding to the shortfall. Low renewable output early in the week also saw high demand on more traditional generation stations. As oil prices fell, winds returned a long with gas flows from the Langeled pipeline. Price pressure dropped sharply by Friday. Low wind output initially pressured electricity prices although again they came off by weeks end. All contracts saw small drops last week despite the volatility. As we suggested in a blog post last week, the closure of the Rough storage facility could create some dramatic price spikes through the winter months, when the UK's ability to cope with cold snaps is likely to be tested by a reduction in storage and potential Qatari import issues. Any clients that are due to renew in mid to late winter may want to contact their account manager about how they can avoid large price swings later in the season. Contact an account manager at any time for advice on your situation. Contact: 0800 043 0423.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money