News

Wholesale energy market update 9/9/16

It was another volatile week in energy, with markets showing an unusual amount of independence from oil pricing. Russia and Saudi Arabia’s promise about “significant proportions” at the next OPEC meetings galvanised markets early on in the week. But with little detail emerging after that, oil prices declined. Oil prices then rebounded after Hurricane Hermine shut down the Gulf of Mexico production and triggered the biggest decline in US storage levels in 30 years.

These rises, however, were short lived, as traders chalked them down to temporary effects. And with the warmer weather throughout Europe, Brent closed the week 2.5 per cent up at $48.01 a barrel.

In the UK, the week brought more very long gas systems which pushed prices down along with falling oil, a stronger pound and a warmer weather forecast well into September.

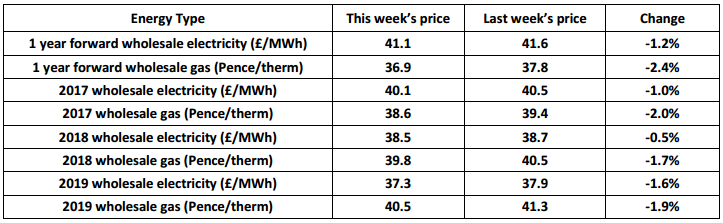

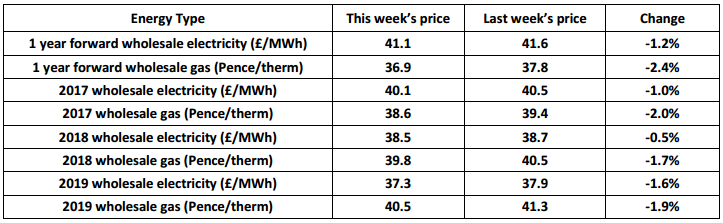

Coal and carbon dropped with continuing solar output and electricity prices tracked down as well, but this downward trend was stunted by a nuclear station going temporarily off line. All contracts saw falls last week.

Prices, particularly gas prices, continue to look attractive. Volatility is likely to increase as the OPEC meeting draws closer, but on a fundamental market level, wholesale prices are still showing at some of their lowest levels in ten years, so long-term contract fixing should still be on buyer’s minds.

In the UK, the week brought more very long gas systems which pushed prices down along with falling oil, a stronger pound and a warmer weather forecast well into September.

Coal and carbon dropped with continuing solar output and electricity prices tracked down as well, but this downward trend was stunted by a nuclear station going temporarily off line. All contracts saw falls last week.

Prices, particularly gas prices, continue to look attractive. Volatility is likely to increase as the OPEC meeting draws closer, but on a fundamental market level, wholesale prices are still showing at some of their lowest levels in ten years, so long-term contract fixing should still be on buyer’s minds.

In the UK, the week brought more very long gas systems which pushed prices down along with falling oil, a stronger pound and a warmer weather forecast well into September.

Coal and carbon dropped with continuing solar output and electricity prices tracked down as well, but this downward trend was stunted by a nuclear station going temporarily off line. All contracts saw falls last week.

Prices, particularly gas prices, continue to look attractive. Volatility is likely to increase as the OPEC meeting draws closer, but on a fundamental market level, wholesale prices are still showing at some of their lowest levels in ten years, so long-term contract fixing should still be on buyer’s minds.

In the UK, the week brought more very long gas systems which pushed prices down along with falling oil, a stronger pound and a warmer weather forecast well into September.

Coal and carbon dropped with continuing solar output and electricity prices tracked down as well, but this downward trend was stunted by a nuclear station going temporarily off line. All contracts saw falls last week.

Prices, particularly gas prices, continue to look attractive. Volatility is likely to increase as the OPEC meeting draws closer, but on a fundamental market level, wholesale prices are still showing at some of their lowest levels in ten years, so long-term contract fixing should still be on buyer’s minds.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money